Bespoke Tranche Opportunity

Table of Contents

Introduction

In many lands of knowledge, the rare and mysterious have little bearing on society. What wins on “Risk!” doesn’t often move markets.

But in finance, insignificances that remain hidden from most can be dreadful. And one such instrument, known as a bespoke tranche opportunity, is on the rise again as big investors hunt for yield in a low-interest-rate market.

So investors need to have at least a fundamental grip on BTOs, which resemble some financial instruments that played an outsize role in the 2008 financial crisis. That downturn destroyed $9.8 trillion of wealth in the U.S. as housing prices and investment accounts took a beating, and millions lost their homes and jobs.

The closing seconds of the 2015 Oscar-winning film “The Big Short” is dedicated to bespoke tranche opportunities, aggressively described as another name for collateralized debt obligations, or CDOs. Those instruments remain closely tied to the U.S. housing market that helped plunge the U.S. into the Great Recession.

What is Bespoke Tranche Opportunity

Bespoke tranche opportunities are a niche structured financial product that allows investors to buy a specific grouping of cash-producing assets in a CDO. For example, suppose a classy investor wanted to gain exposure to a pool of BBB-rated mortgages in the Southwest or a grouping of AAA-rated U.S. auto loans. In that case, they could use a bespoke tranche opportunity to make that happen.

“A tranche is, if you will, a slice of the risk,” says Janet Tavakoli, president of Tavakoli Structured Finance LLC, a Chicago-based risk consultancy firm for derivatives and structured finance. While CDOs will bundle all loans of a particular type together, with a BTO, “you’re going to pick one specific tranche.”

Although the market is waterproof, demand in recent years has been robust. In 2018, trading volume in synthetic CDOs clocked in at more than $200 billion, according to a Reuters report. To some, this may echo loudly of the financial crisis, when banks faced flowing liabilities from leveraged bets on pools of loans that went sour, in some cases despite genuine credit ratings.

How to Bet Against Bespoke Tranche Opportunity

We can bet on the bespoke tranche opportunity by knowing its disadvantages. The more modified the CDO, the less likely it will demand from another investor or investors. The significant drawback remains that there is typically slight to no secondary market for bespoke CDOs. This lack of market makes daily rating difficult. The value must remain calculated and built on complex academic and financial models. Those models can make assumptions that turn out to be wrong, estimate the holder significantly and leave them with a financial instrument they cannot sell at any price.

Then there is the lack of transparency and liquidity that accompanies over-the-counter transactions in general and these instruments in particular. As unregulated products, bespoke CDOs remain relatively high on the risk scale—more suitable for institutional investors, like hedge funds, than individuals.

Unlike stocks or exchange-traded funds that trade publicly in high volumes every day, BTOs, as specially tailored investments among institutions, aren’t very liquid and can be challenging to establish a value for on a day-to-day basis. That illiquidity also makes them challenging to offload when you want to exit the trade.

“CDOs are extremely similar to bespoke tranches in that they are relatively illiquid, and it is difficult to model how they will act in times of market stress,” says Lisa Fall, CEO of the Boston Security Token Exchange.

On top of that, BTOs are unregulated, which compounds the risk involved due to the lack of oversight. It remains an open issue. How do you prevent blatant fraud or erroneous risk ratings?

How to Buy Bespoke tranche opportunity

The conventional bespoke tranche opportunity carries out the task of pooling several assets like loans, bonds, and mortgages. These further help to generate a steady flow of cash.

These risk levels are managed according to the creditworthiness of the fundamental asset. This is so only because each and every part or tranche of a single CDO offers varied rates of returns. When more assets of tranches have the chance of avoidance, there will be higher returns offered through them.

Worthy of note is that bespoke tranche opportunities do not appear to remain graded through significant rating firms. Some issuers carry out the task of assessing the creditworthiness of different assets.

Market opinions will be put into account but only to a reasonable extent. We have an OTC procedure to follow when trading in bespoke tranche opportunities. It, in other words, means that you can sell a CDO over the counter.

How to Short Bespoke Tranche Opportunity

The name Bespoke Tranche Opportunity stood first used in January 2015 via Goldman Sachs in an e-mail from a worker at the investment bank. The employee defined as follows: “A tranche of a bespoke collection of credits can increase exposure to spread risk with the possibility of leverage, credit enhancement and enhanced returns”. It calls for investors to find new ways to improve their returns. In the current state of the worldwide economy, the returns have almost stood divided three times using opposed to the returns in 2008 at its peak.

The creation of a BTO starts with an investor that tells a bank a mixture of offshoots he wants to invest in. A bank then packs all these ‘bets’ into one tranche of a BTO. The tranche meets the exact wishes of the investor; every tranche is unique and will never be an imitation. The bank, in its turn, combines the wishes of a small group of investors, usually only 2 or 3, into one security called the BTO. Similar to a CDO, a BTO consists of different tranches that make up a pool of bonds, thus creating security.

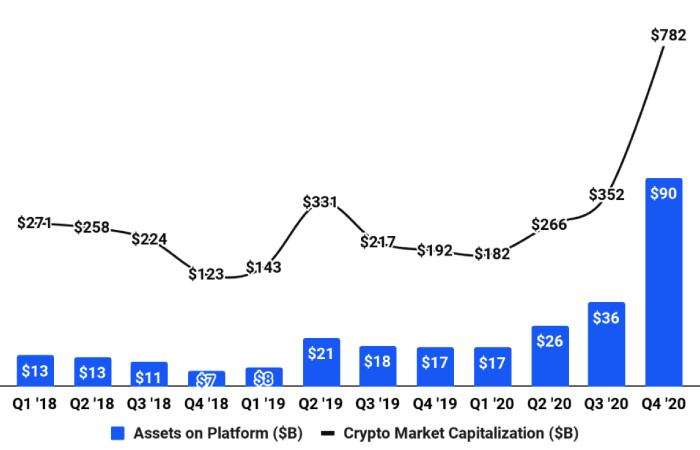

Bespoke Tranche Opportunity Chart

Conclusion

Conceding a BTO is a form of a CDO in such a way that it contains a pool of secur5 cities; there are, however, approximately critical differences between the two. If you stand to read financial newspapers, you will read that a BTO remains the same as a CDO. It does not have to be accurate.

As stated above, a BTO remains created according to the investor’s preference, as opposed to a CDO created by a bank and then sold on the market. This discrepancy is, however, a small, very important one. It circumvents a part of the regulations set by governments around the world. Before the crisis, these kinds of CDOs stood called synthetic CDOs. Besides being a synthetic CDO, a BTO is called a single-tranche CDO. A single-tranche CDO is a type of CDO where all the notes have the investor, called a full-capital structure. In such a structure, the tranches are all possessed by the investors—this structure, therefore, principals to the banks having negligible risk.

The investors are the ones that have to take all the trouble. The last and maybe the most substantial distinction is that the underlying assets in BTOs are derivatives, not asset-backed securities. As was the case with most CDOs. It causes the value of the BTOs to be not directly linked to the performance of the real economy, as most bonds would be, but slightly to the rating of the rating agencies.